UBIT Compliance Calculator

Calculate Your Unrelated Business Income Tax Risk

This tool helps determine if your nonprofit's revenue activities might trigger Unrelated Business Income Tax (UBIT) under IRS rules. Enter your organization's revenue data to check compliance.

Ever wondered why you see community bake sales, marathon runs, and after‑school tutoring sessions all labeled as nonprofit activity? You’re not alone. The term gets tossed around a lot, but most people can’t pin down what actually qualifies as a nonprofit activity, how it differs from a for‑profit venture, or why the rules matter.

Key Takeaways

- A nonprofit activity is any action carried out by a tax‑exempt organization that furthers its charitable purpose.

- IRS rules, especially the 501(c)(3) status, define the legal boundary between permissible and prohibited activities.

- Common categories include fundraising events, direct service programs, advocacy, grantmaking, and educational outreach.

- Effective planning, clear documentation, and impact measurement keep activities compliant and successful.

- Typical pitfalls involve private benefit, unrelated business income, and inadequate record‑keeping.

Defining a Nonprofit Activity

Nonprofit activity is a task, program, or event undertaken by a tax‑exempt organization that directly advances its charitable mission as defined by law. In simple terms, if an organization exists to help people, protect the environment, or promote education, any action that pushes those goals forward counts as a nonprofit activity.

Contrast this with a commercial venture: a for‑profit company may sell the same product, but its primary aim is to generate profit for owners. A nonprofit, even when it sells merchandise, must reinvest every dollar into its mission.

Legal Backbone: 501(c)(3) and the IRS

Most U.S. nonprofits operate under the 501(c)(3) section of the Internal Revenue Code that grants federal tax‑exempt status. This status brings two big perks: donors can deduct contributions on their taxes, and the organization itself is exempt from federal income tax.

The Internal Revenue Service (IRS) monitors compliance. If an organization strays into activities that benefit private interests, generate unrelated business income, or divert funds to personal gain, the IRS can revoke the 501(c)(3) status.

Key legal concepts you’ll hear:

- Private benefit - any enrichment of a specific individual or corporation beyond the mission.

- Unrelated Business Income Tax (UBIT) - tax on earnings from activities not substantially related to the charitable purpose.

- Public support test - a measurement that at least one‑third of the organization’s revenue must come from the general public.

Common Types of Nonprofit Activities

Nonprofit missions look different, so their activities vary widely. Below is a quick rundown of the most frequent categories.

| Activity Type | Primary Goal | Typical Example | Key Compliance Focus |

|---|---|---|---|

| Fundraising Event | Raise money for program budgets | Charity run, gala dinner | Donor acknowledgement, UBIT rules |

| Direct Service Program | Deliver help directly to beneficiaries | Free meals, after‑school tutoring | d>Program evaluation, outcome reporting|

| Advocacy Campaign | Influence public policy | Letter‑writing drives, public hearings | Lobbying limits (≤$5,000/year) |

| Grantmaking | Fund other nonprofits | Community foundation awards | Due‑diligence, conflict‑of‑interest policies |

| Educational Outreach | Raise awareness, build capacity | Workshops, webinars | Accurate info, non‑commercial pricing |

Each type serves a distinct purpose but shares the same compliance backbone: stay mission‑centric and avoid private gain.

Planning a Successful Nonprofit Activity

Think of planning as a roadmap that keeps you inside the legal lane while reaching your charitable destination. Follow these steps:

- Clarify the mission link: Write a one‑sentence statement connecting the activity to your organization’s purpose.

- Identify stakeholders: List volunteers, donors, beneficiaries, and any partners. For volunteers, outline roles, training, and liability coverage.

- Budget realistically: Include venue costs, permits, insurance, and a line item for potential UBIT‑triggering revenue.

- Secure approvals: Get board sign‑off and, if needed, a pre‑approval from the IRS for large lobbying efforts.

- Document everything: Keep contracts, receipts, and minutes in a dedicated folder. Documentation is the first defense in an audit.

- Promote ethically: Use truthful messaging, avoid “false cause” claims, and honor donor privacy rules.

- Measure impact: Define clear metrics (e.g., dollars raised, people served, policy changes) and collect data during the event.

- Report back: Share results with donors, volunteers, and the public. Transparency builds trust and satisfies annual reporting requirements.

Measuring Community Impact

Impact measurement turns a good idea into proof of effectiveness. Here’s a quick framework you can apply to any activity:

- Input: Resources spent (time, money, supplies).

- Output: Direct products (meals served, tickets sold, petitions signed).

- Outcome: Short‑term changes (increased awareness, improved nutrition).

- Impact: Long‑term effects (reduced homelessness rates, policy adoption).

Collecting data can be as simple as a post‑event survey or as robust as a longitudinal study partnered with a local university.

Common Pitfalls and How to Avoid Them

Even seasoned nonprofits slip up. Spot the traps before they bite:

- Private Benefit: If a fundraiser’s proceeds go straight to a board member’s business, the IRS will flag it. Keep all revenue in the organization’s accounts.

- Unrelated Business Income: Selling T‑shirts at a charity run can be fine, but if the shirts become the primary revenue source, you may owe UBIT. Track sales and compare to total income.

- Excessive Lobbying: Advocacy is allowed, but spending more than $5,000 a year on lobbying can jeopardize 501(c)(3) status. Use a separate “political” budget and document each effort.

- Poor Record‑Keeping: Audits are rare but costly. Digital bookkeeping tools (e.g., QuickBooks Nonprofit) make it easy to generate the required Form 990 schedules.

- Volunteer Liability: Without proper insurance or waivers, a single accident can expose the organization to lawsuits. Secure general liability coverage and have volunteers sign acknowledgment forms.

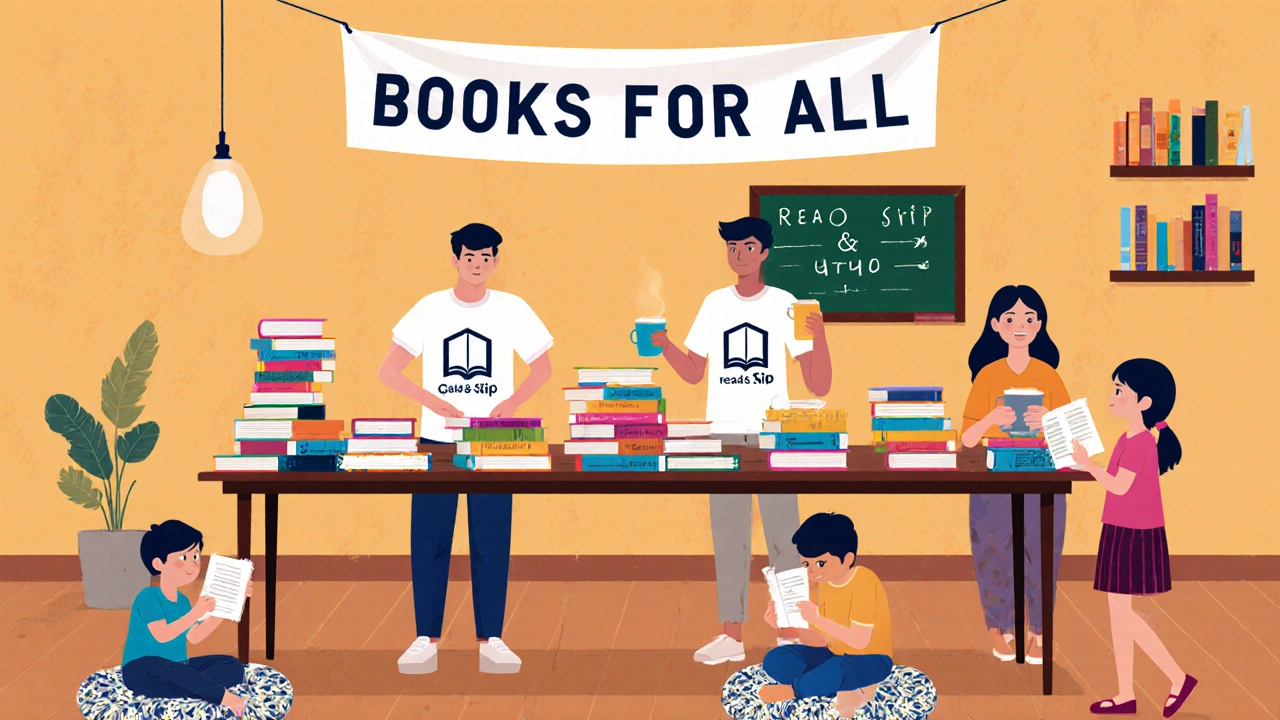

Real‑World Example: The “Books for All” Summer Campaign

Imagine a small literacy nonprofit launching a summer reading drive. They organize a community book‑swap, partner with a local cafe for a “Read & Sip” night, and run a crowdfunding page.

Here’s how it matches the checklist:

- Mission link: “Promote literacy among under‑served youth.”

- Stakeholders: Volunteers (students), donors (parents), beneficiaries (children).

- Budget: $2,000 for venue, $500 for marketing, $300 for insurance.

- Compliance: Board approves, IRS pre‑approval not needed (no lobbying).

- Documentation: Signed venue contract, volunteer sign‑ins, expense receipts.

- Impact metrics: 150 books swapped, 45 new volunteers recruited, 300 children reached.

The campaign stays tax‑exempt, raises $5,400, and reports a clear boost in community reading rates. It’s a textbook example of a compliant, effective nonprofit activity.

Quick Checklist Before Launching

- Confirm activity aligns with your organization’s tax‑exempt purpose.

- Document the mission connection in writing.

- Secure board approval and any required IRS permissions.

- Prepare a detailed budget, flagging potential UBIT items.

- Arrange liability insurance and volunteer waivers.

- Set measurable impact goals and a data‑collection plan.

- Plan post‑event reporting for donors and regulators.

Frequently Asked Questions

Frequently Asked Questions

What distinguishes a nonprofit activity from a for‑profit activity?

A nonprofit activity directly furthers the organization’s charitable purpose and any surplus is reinvested in that purpose. A for‑profit activity aims to generate profit for private owners or shareholders.

Do I need a special license to hold a fundraising event?

Most states require a charitable solicitation registration if you raise more than a certain amount. Check your state’s Attorney General office for thresholds and filing deadlines.

Can volunteers receive compensation for their work?

Volunteers may be reimbursed for out‑of‑pocket expenses, but paying a salary turns them into employees, which introduces payroll taxes and labor law obligations.

What is Unrelated Business Income Tax (UBIT) and how does it affect activities?

UBIT applies when a nonprofit earns income from a trade or business not substantially related to its mission. The income is taxed at corporate rates and must be reported on Form 990‑T.

How much lobbying can a 501(c)(3) organization do?

The IRS limits lobbying expenditures to a small percentage of total budget, averaging about $5,000 per year. Exceeding the limit can jeopardize tax‑exempt status.

Understanding what makes an action a nonprofit activity equips you to design programs that comply with the law, attract donors, and generate real community change. Whether you’re planning a bake sale or a policy‑shaping conference, keep the mission front‑and‑center, document every step, and measure the impact. That’s the formula for sustainable, purpose‑driven success.