Charitable Trust Calculator

How much can you fund long-term?

Calculate if your funds can support a charitable trust based on UK regulations and real-world costs

Thinking about creating a charitable trust? You're not alone. Every year in the UK, hundreds of people decide to turn their personal resources into lasting good - not just for a season, but for decades. But before you sign anything, you need to know what this really means. It’s not just writing a cheque. It’s setting up a legal structure that will outlive you. And it comes with responsibilities, costs, and rules you can’t afford to ignore.

What exactly is a charitable trust?

A charitable trust is a legal arrangement where you give money or assets - like cash, property, or shares - to be used for charitable purposes. Unlike donating directly to a charity, a trust gives you control over how the funds are used, who benefits, and how long the giving lasts. It’s like creating your own charity, but without the full staff or overhead.

In England and Wales, a charitable trust must meet two key tests: it must have a charitable purpose (like relieving poverty, advancing education, or protecting the environment), and it must provide public benefit. The Charity Commission keeps a close eye on this. If your trust doesn’t clearly serve the public, it won’t be registered - and you won’t get tax breaks.

Why would someone set one up?

People create charitable trusts for three main reasons.

- Legacy control: You want your name or values to live on. Maybe you’ve spent 30 years mentoring young artists. A trust lets you fund that work forever, even after you’re gone.

- Tax efficiency: Assets you put into a charitable trust are usually free from inheritance tax. If you leave £500,000 to your trust instead of your family, your estate pays nothing to HMRC on that amount. And the trust itself doesn’t pay income or capital gains tax on its investments.

- Flexibility: Unlike donating to an existing charity, you decide the rules. You can say, “This £200,000 must go to youth mental health projects in Bristol,” and no one else can redirect it.

But here’s the catch: it’s not cheap or simple. You’ll need lawyers, accountants, and ongoing paperwork. If you’re only looking to give £10,000 once, a trust is overkill. You’re better off donating directly.

How much money do you need?

There’s no official minimum, but in practice, you need at least £100,000 to make a charitable trust worth the effort. Why? Because running one costs money.

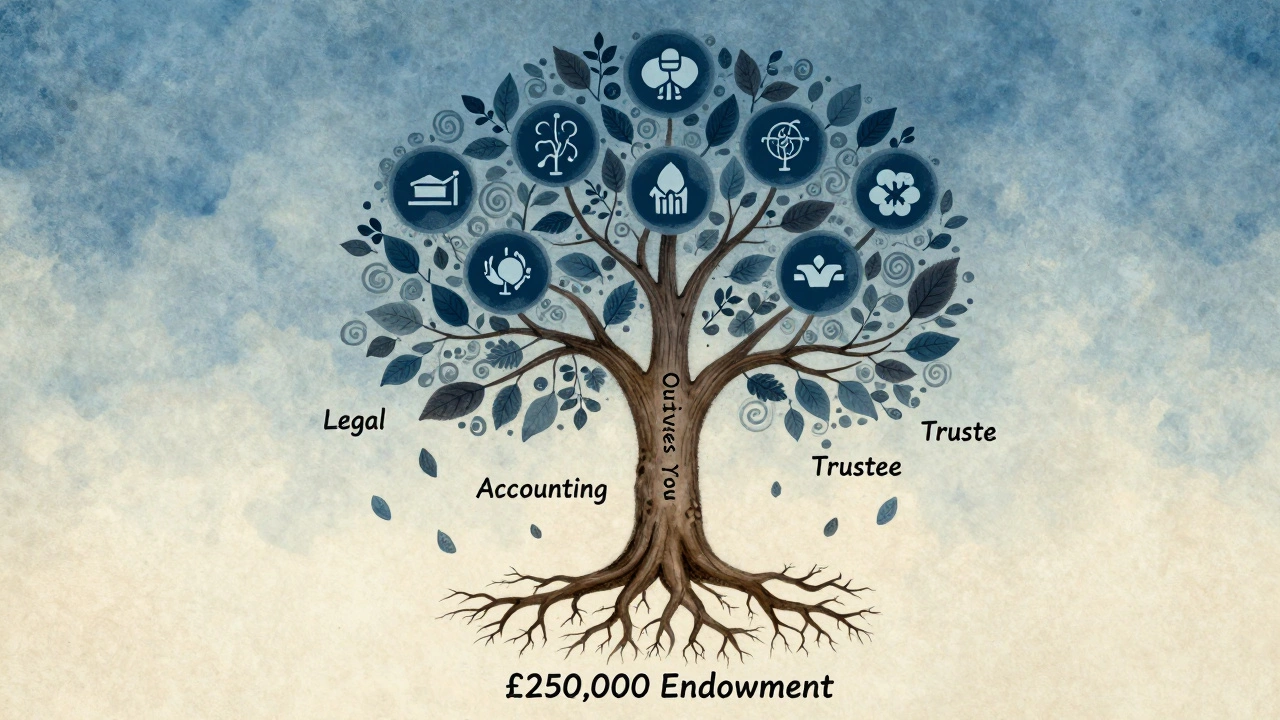

Here’s what you’ll pay in the first year:

- Legal setup: £3,000-£6,000 (trust deed, registration, compliance)

- Accountant fees: £1,500-£3,000 (annual accounts, tax returns)

- Trustee costs: £0 if volunteers, but if you hire a professional trustee - £5,000+

- Investment management: 1-2% per year of the trust’s value

So if you put in £50,000, you might spend £10,000 just to get it running - and then pay £1,000 a year just to keep it alive. That’s not sustainable. Most people who set up trusts start with £250,000 or more. That way, even after fees, they can still give away £10,000-£20,000 a year.

Who runs it?

You can’t run it alone. A charitable trust needs at least three trustees. These are the people legally responsible for everything - spending the money, filing reports, hiring staff, even defending the trust in court.

Most people pick:

- One family member (like a child who shares your values)

- One professional (a solicitor or accountant)

- One person from the charity sector (someone who knows how nonprofits work)

But here’s where things get tricky: trustees are personally liable. If they mismanage funds, they can be sued. That’s why many people hire a professional trustee company - but that costs £5,000-£15,000 a year.

And if you die? Your trustees still have to carry on. That’s why your trust deed needs clear instructions: Who replaces them? What happens if they quit? How are decisions made?

What can you fund?

Not everything counts as charitable. The Charity Commission has strict rules. Here’s what works:

- Helping people in poverty (including homeless shelters, food banks, debt advice)

- Advancing education (scholarships, school supplies, after-school programs)

- Protecting the environment (tree planting, wildlife reserves, clean water projects)

- Advancing health (mental health services, medical research, hospice care)

- Relieving hardship due to age, illness, disability

- Promoting human rights, equality, or community development

Here’s what doesn’t:

- Helping your own family (unless it’s part of a wider public benefit)

- Supporting political parties or lobbying

- Funding religious worship (unless it’s part of broader community service)

- Buying a statue of yourself

One real case from Bristol: A man set up a trust to fund “public art in underserved neighborhoods.” The Charity Commission approved it - because it was open to all, not just his friends. But when he tried to fund only sculptures of his late wife? They rejected it. Public benefit isn’t personal.

What’s the alternative?

You don’t have to create a trust. There are simpler ways to give:

- Donor-advised fund (DAF): Put money into a fund managed by a charity like the Bristol Community Foundation. You recommend grants, they handle the paperwork. Costs under £1,000 to start. Minimum £5,000.

- Leave it in your will: Just name a charity as a beneficiary. No setup costs. Easy to change. No ongoing work. Set up a community fund: Work with an existing charity to create a named fund under their umbrella. They handle compliance. You just decide where the money goes.

Most people who think they need a trust actually don’t. A donor-advised fund gives you nearly all the benefits - control, tax savings, legacy - without the legal headaches.

What happens if you change your mind?

Once you put money into a charitable trust, it’s gone. You can’t take it back. Even if you get sick, go broke, or change your values - the money stays in the trust.

That’s why many people include a “sunset clause” in their trust deed: “If the trust can’t operate for five years, the remaining funds go to [another charity].”

And if you want to change the purpose? You need permission from the Charity Commission. That can take months. And they won’t let you redirect money to your new business idea.

Is it right for you?

Ask yourself these five questions:

- Do I have at least £250,000 to put into this - not just for setup, but to keep giving for 20+ years?

- Do I have a clear, lasting cause I’m passionate about - not just a temporary urge?

- Can I find three trustworthy people who’ll carry this on after I’m gone?

- Am I prepared to pay £10,000+ in setup costs and £5,000+ per year in fees?

- Do I want to control how the money is used - or am I okay letting an existing charity handle it?

If you answered yes to all five - then a charitable trust might be worth exploring.

If you said no to even one? Talk to a financial advisor who specializes in philanthropy. There’s almost certainly a simpler, cheaper way to make the same impact.

Creating a charitable trust isn’t about status. It’s about legacy. And if you’re doing it right, it won’t just change lives - it will outlive you.

Can I set up a charitable trust with just £50,000?

Technically yes, but it’s not practical. Running a charitable trust costs at least £5,000-£10,000 a year in fees. With £50,000, you’d burn through your capital in under a decade. Most people who start with less than £100,000 end up closing the trust within five years. A donor-advised fund is a far better option at this level.

Do I need a lawyer to set up a charitable trust?

Yes. A charitable trust requires a legally binding trust deed, registration with the Charity Commission, and compliance with UK charity law. DIY templates won’t cut it. A solicitor who specializes in charitable trusts will ensure your wording is watertight and your intentions are enforceable. Skipping this risks losing tax relief or even getting the trust shut down.

Can I be a trustee and also benefit from the trust?

No. Trustees cannot personally benefit from the trust’s assets - that’s a breach of fiduciary duty. You can’t pay yourself a salary unless you’re hired as a professional employee under strict conditions. Even then, it must be approved by the Charity Commission and be reasonable. Any personal gain, even indirect, can lead to legal penalties.

How long does it take to set up a charitable trust?

If everything goes smoothly, it takes 3-6 months. Drafting the trust deed: 2-4 weeks. Charity Commission registration: 4-12 weeks. Getting your bank account open and investments set up: another month. Delays happen if your purpose is unclear or your trustees aren’t properly vetted. Plan ahead.

Can I fund a charitable trust from my pension?

Yes - but only if you’re over 55 and have a defined contribution pension. You can withdraw up to 25% tax-free and donate it to a trust. The rest is taxed as income. You can’t transfer the whole pension pot directly. Talk to a pensions specialist first. Some providers allow this; others don’t. And remember: once it’s in the trust, it’s gone for good.